* Work

out the monthly budget & stick to it as far as possible.

* Note down total of direct & indirect income.

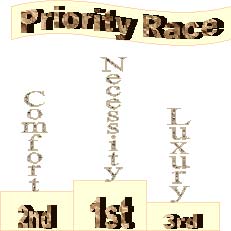

* Prepare list of requirements according to priorities. Set first priority

to necessity, second to comfort & third to luxury.

* While preparing monthly budget keep provisions for:

| Eatables | Education | Medical | Bills - maintenance, electricity, telephone, internet... | ||

| Instalments | Interest | Clothes | Savings | Entertainment | Investments |

* After deducting

above expenses try to manage other things with the amount available.

* If market is at

walk-able distance from your home, avoid purchasing vegetables, fruits

& other homely necessities from hawkers sitting outside your building/apartment.

* Keep records of newspaper, milk ordered every day, cloth given for ironing

etc… so that you can prevent yourself from being cheated through

cross checking.

* Every time after shopping list down each & every expenses. So that

you can tally total monthly expense with balanced cash.

* Pay your bills, fees & other payments in time to save the penalty

amount.

* Don't try to copy your rich neighbours & indulge in extra/unnecessary

expenses.

* While purchasing routine cloths, purchase such cloths, which can be

easily, hand washed.

* Do not get trapped by any instalment schemes, as the interest charges

will create more burdens.

* Never do shopping in hurry.

* Don't purchase unnecessary things just because you like it.

* Parents can teach their children as long as possible & can further

train them for self study & hence can save tuition fees.

* Use your elder children's cloth, uniform, study material etc. for younger

children.

* If school is at long distance, make a group of 4-5 children & hire

a vehicle.

* If you are going outside for more than 60 days, suspend your phone service

temporarily.

* If possible go for bulk purchase of daily necessities, preferably from

wholesale market.

* For long distance prefer train journey than bus journey as it saves

your time & money.

* Be alert & save electricity by putting off T.V., fan, light etc.

when not required, not keeping fridge open for long time, keeping door

closed when A/C is on.

* Instead of buying sweets & farsan from shop, it's better to make

at home. It not only will reduce the cost but you also get more quantity

& of better quality.

* Check out your major money stealer & try to replace those likes.

For e.g. - Instead of having costly cuisine at restaurant try some new

varieties at home. During picnics carry eatables from home. For outings

or sight seeing, plan in advance & hire vehicle for whole day.

* Instead of wasting money on cinema's ticket for a group of people, it's

better to watch movie on MP3.

* Use various electronic devices as per instruction to prevent excess

use of electricity. E.g. pre heat oven before cooking.

* Never invest your entire income in one scheme or at any one place.

* Make adequate investment for your future.

* Inquire about various schemes & ways available for child's future

security.

* Chances of fraud & insolvency are higher in private firms/company

than in any government scheme/policy.

* Various investment options:

| Mediclaim | NSC, KVP, PPF... | Bank FD | Gold, silver, diamond... |

| Mutual fund | Real estate | LIC, UTI... | Shares, debentures, bonds... |